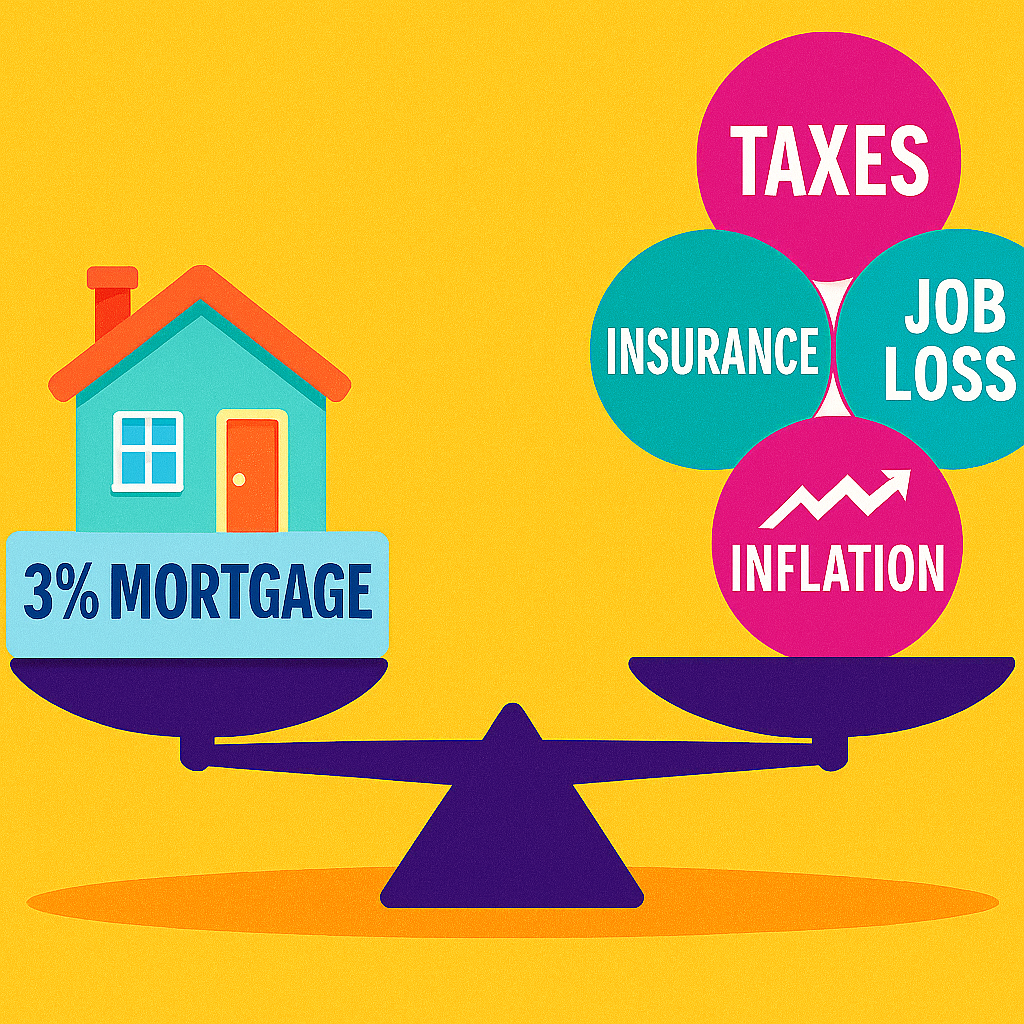

The Myth: “No One’s Selling Because of Low Rates”

You’ve probably heard it a dozen times:

“Nobody wants to sell because they’re locked into a 3% mortgage.”

It sounds logical… but it’s not true anymore.

Because if you’ve been watching the market in North Jersey lately, you know what’s actually happening:

Inventory is up. Homes are hitting the market. Sellers are making moves.

📊 The Data:

- According to Redfin, 1 in 5 U.S. homeowners who sold in Q1 2025 had mortgage rates below 4% (Redfin, May 2025).

- In New Jersey, there were 16,379 active home listings in May 2025—an increase of 15.69% from April 2025 and 24.11% compared to May 2024, according to Realtor.com and confirmed by the Federal Reserve Bank of St. Louis (Realtor.com via FRED, June 2025).

So, what gives?

Let’s Break It Down

Mortgage rates are higher than they were in 2021. No argument there.

But a record number of New Jersey homeowners are still putting the “For Sale” sign in the yard.

Why?

✅ Reason #1: Life Happens, Mortgage Be Damned

- You can’t stop a job relocation.

- You can’t ignore aging parents who need care.

- You can’t raise three kids in a two-bedroom just because your rate is low.

Real life beats interest rates.

People are moving for school districts, downsizing after divorce, or upgrading because they’ve outgrown their current space.

Nearly 32% of sellers in 2025 cited life changes (family, job, health) as their reason for moving, not financial hardship or rate hikes (Zillow Consumer Trends Report, 2025).

📉 Staying put isn’t always the “cheaper” option when the rest of your life suffers.

✅ Reason #2: Tapping Into Massive Equity

Many NJ homeowners have built up 6-figures in equity just by sitting still the past few years.

If you bought in 2015–2019, you’re likely sitting on a goldmine.

Homeowners in Bergen County gained an average of $183,000 in equity between 2020 and 2024 (CoreLogic Q1 2025 Equity Report).

NJ median home prices hit $547,500 in April 2025, up 7.4% YoY (NJ Realtors, May 2025).

“Why would I sell and take on a higher rate?”

Because you’re trading a monthly rate for a one-time, life-changing cash-out.

Some sellers are using their equity to:

- Pay off debt

- Buy another home all-cash

- Fund retirement

- Start a business

- Move out of high-cost New Jersey altogether

✅ Reason #3: Job Loss and Financial Strain

Even with a low mortgage rate, losing your income changes everything.

As of May 2025, New Jersey’s unemployment rate climbed to 5.2%, above the national average of 4.0% (U.S. Bureau of Labor Statistics, 2025).

When homeowners lose their jobs, it’s not just about paying the mortgage. It’s about keeping up with taxes, insurance, and everyday expenses. A low monthly mortgage means little when there’s no income coming in.

Many sellers in today’s market aren’t choosing to move — they’re being forced to, just to stay ahead of mounting bills or avoid slipping into preforeclosure.

Now let’s not sugarcoat the other life events forcing sales…

Let’s not sugarcoat it.

Sometimes people are forced to sell:

- After a divorce

- After a death in the family

- After falling behind on property taxes or repairs

In 2024, 34% of NJ home sales were involuntary life event sales, according to ATTOM Data Solutions.

No mortgage rate is low enough to fix a broken relationship or pay for a new roof.

The “lock-in” myth only works when life is stable. But when it’s not? The house has to go.

✅ Reason #4: Out of State = Out of Jersey Taxes

New Jersey’s property taxes are still the highest in America, averaging 2.23% of home value.

That equals $9,300/year on a $417,000 home — and up to $13,600+ in Bergen and Essex counties (WalletHub, 2025).

Combine that with rising:

- Insurance premiums 🏡

- Utility costs ⚡

- Maintenance and HOA fees 💰

And even a paid-off house can feel like a financial trap.

A recent Bankrate study found NJ’s “hidden homeownership costs” now average $29,700/year — 2nd highest in the U.S.

That’s why so many of my clients are leaving Bergen, Passaic, and Essex Counties for:

- Pennsylvania

- The Carolinas

- Florida

- Tennessee

Low-rate mortgage or not—quality of life is the bigger motivator.

✅ Reason #5: Wages Aren’t Keeping Pace with Inflation

Even if you’re locked into a low-rate mortgage, your paycheck might not be stretching as far as it used to.

Real wages fell by 3.2% nationally between December 2020 and December 2024, as prices rose faster than paychecks (U.S. Bureau of Labor Statistics).

A 2025 JPMorganChase Institute analysis found real (inflation-adjusted) earnings have stagnated across all income groups over the past year, even as inflation and home costs continue to climb.

The result? Even homeowners who secured great mortgage deals are facing squeezed monthly budgets as housing costs grow and take-home pay lags behind. That mismatch is driving more sellers to list their homes out of necessity—not opportunity.

✨ The Bottom Line:

If you’re thinking of selling, you’re not alone—and you’re not crazy.

Despite higher rates:

📈 Inventory is rising

📊 Buyers are adapting

🏡 Homes in good condition are still getting strong offers

📈 The best move?

Work with someone who understands both the traditional sale market and off-market investor options—so you get the best outcome no matter your situation.

Ready to Sell in 2025 But Unsure About Timing or Repairs?

Let’s talk. I help NJ homeowners:

- Sell traditionally or off-market

- Navigate complex life transitions

- Close quickly with investor partners if needed

👉 Schedule a no-pressure call with me

Or send me a message right now and I’ll give you real answers—not sales fluff.

Kevin Hill

Real Estate Agent & Distressed Property Specialist

📍 Bergen County, NJ

📞 201-214-1349

🌐 www.NJHousePartners.com