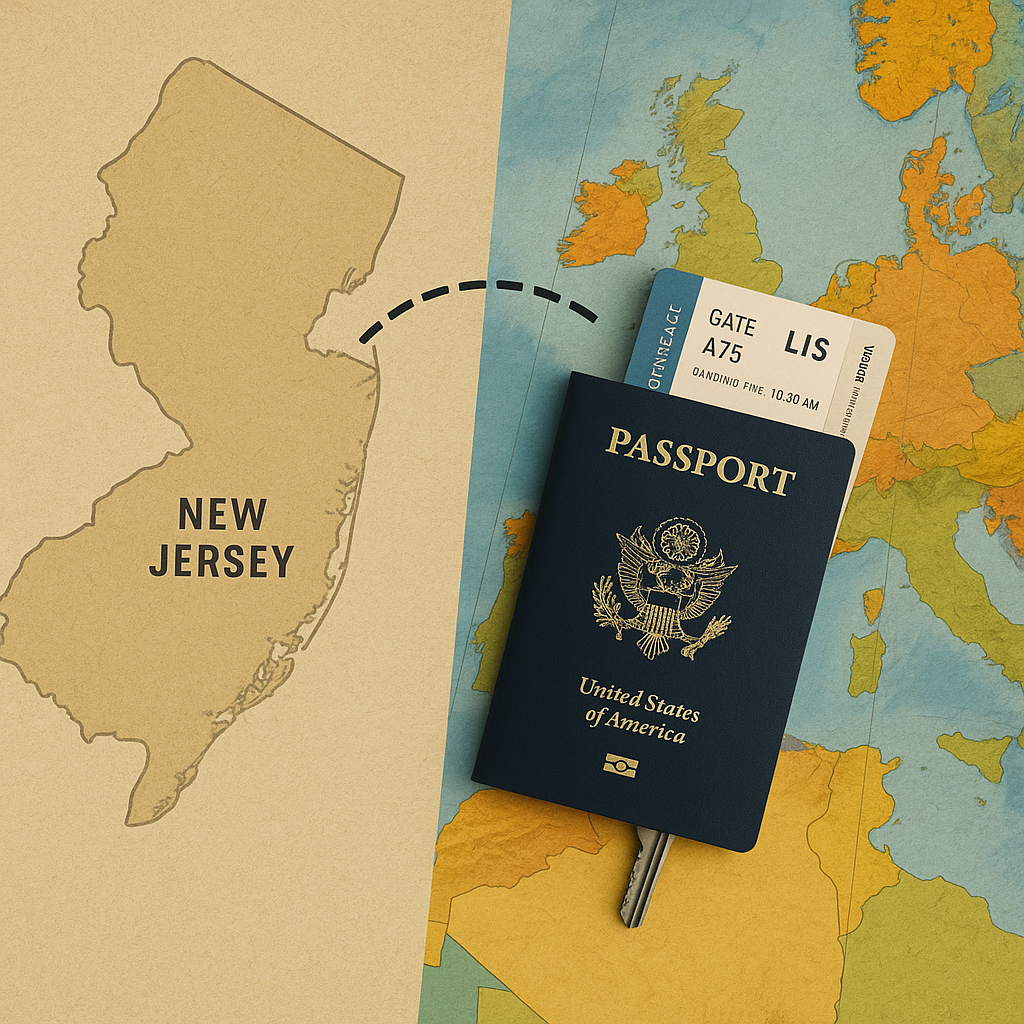

Ready for Your Big Stage-Left Exit? 🎭”

Maybe the current political climate in the United States just is not for you anymore. Maybe the Jersey winters are too cold, the property taxes too high, or you just want to be somewhere you can actually afford a waterfront property without the MTV Jersey Shore cast lurking around. Or maybe you’re following in the footsteps of headline-seeking celebrities—Rosie O’Donnell, who fled to Ireland after Trump spent years calling her a ‘pig’ and a ‘loser,’ and Ellen DeGeneres, now hiding in the English countryside after multiple insiders described her as a tyrant who made her staff ‘real scared’, all because Trump strutted back into the White House in 2025. Whatever your reason, you are thinking about selling your house and starting fresh overseas.

Moving abroad is part exciting adventure, part logistical minefield. It is not just about finding a beach where margaritas cost $2 🍹 and healthcare will not bankrupt you. It is also about navigating the U.S. tax code, immigration rules, the fine print on your Social Security benefits, and understanding how your life will change when you wake up in a completely different country.

This guide will walk you through the steps, pitfalls, and strategies to make your international move smoother, starting with the sale of your New Jersey home.

1. Sell Your U.S. Home the Smart Way 🏡

Before you can live your expat dreams, you need to unlock the equity in your NJ home.

- Market Timing Matters: North Jersey’s real estate market can be unpredictable. In low-inventory periods, you may be able to command top dollar. In a buyer’s market, you may need to be more aggressive with pricing. Remember that certain times of the year, like late spring and early summer, tend to bring more buyers.

- As-Is vs. Full Prep: If you are short on time, consider selling as-is to a cash buyer. This avoids the cost and stress of repairs and upgrades. On the other hand, if you have flexibility, consider light renovations like fresh paint, landscaping, or new lighting fixtures to maximize resale value.

- International Buyer Opportunities: Believe it or not, there are buyers from overseas who specifically invest in U.S. properties. A skilled agent can market your home to these buyers to potentially secure a quick sale.

- Understand Closing Timelines: In New Jersey, a standard closing takes 30 to 45 days after an offer is accepted. If you need funds from your sale to apply for a visa or buy property abroad, work backwards from your target departure date to avoid delays.

2. Exit Taxes and the IRS Will Not Forget You Exist 💰

Selling your house and moving abroad does not mean you can stop filing taxes.

- Capital Gains Tax: You may be able to exclude $250,000 in profit if single, $500,000 if married and filing jointly, provided you lived in the home for 2 of the last 5 years. Profits above the exclusion are taxed federally and possibly by New Jersey.

- State “Exit” Taxes: While not an official “exit tax,” New Jersey requires sellers who move out of state to pay estimated taxes at closing to ensure they meet their obligations. This can be a surprise if you are not prepared.

- Worldwide Income Rule: The U.S. taxes its citizens on income earned anywhere in the world. You will still need to file an annual return even if you live abroad permanently, unless you renounce your citizenship.

- Foreign Earned Income Exclusion: If you earn income abroad, you may be eligible to exclude up to $126,500 (2024 figure, adjusted annually) from U.S. taxation, but this does not apply to all income types, such as pensions or investment income.

- Foreign Bank Account Reporting (FBAR): If you have more than $10,000 combined in foreign bank accounts at any time during the year, you must report it to the Treasury Department. Penalties for noncompliance can be severe.

3. Visas, Residency, and Paperwork That Could Make You Cry 😭

Visa rules vary greatly by country and purpose of stay.

- Retiree Visas:

- Portugal D7 Visa: Requires proof of income or savings, such as a pension, rental income, or dividends.

- Costa Rica Pensionado: Requires at least $1,000 monthly from a pension or Social Security.

- Panama Pensionado: Requires proof of lifetime income and offers discounts on healthcare, travel, and utilities.

- Remote Work Visas:

- Croatia Digital Nomad Visa: Valid for up to one year, requires proof of income and accommodation.

- Estonia Digital Nomad Visa: Allows you to live in Estonia while working remotely for a non-Estonian company.

- Golden Visas: Countries like Greece and Spain grant residency to those who purchase real estate above a certain value, often €250,000 to €500,000.

- Visa Renewal Traps: Some countries require you to leave and re-enter periodically, which can complicate life if you are not prepared.

4. Collecting Social Security From a Beach Chair 🏖️

Social Security benefits generally can be paid overseas, but there are exceptions.

- Totalization Agreements: The U.S. has agreements with many countries to avoid double taxation of Social Security and to combine work credits from both countries.

- Restricted Countries: Benefits cannot be sent to certain countries like North Korea and Cuba, and may be limited in others.

- Proof of Life Requirements: Some countries require annual “proof of life” forms to ensure you are still eligible for payments.

- Banking Strategy: Keeping a U.S. bank account can make deposits and currency transfers easier. Using a multi-currency account can reduce conversion costs.

5. Dual Citizenship and Passport Perks 🌍

Dual citizenship can be a huge advantage but also comes with obligations.

- Ancestry Citizenship Examples:

- Ireland: If you have a grandparent born in Ireland, you may qualify.

- Italy: Recognizes citizenship through multiple generations if documentation is available.

- Investment Citizenship:

- St. Kitts and Nevis: Citizenship in exchange for a real estate investment starting around $200,000.

- Tax Treaties: Some countries have agreements with the U.S. to reduce double taxation, but you must still file annually.

6. The Logistics No One Tells You About 📦

These “hidden” steps can make or break your move.

- Pets: Australia has a 10-day quarantine requirement, while the UK requires proof of rabies vaccination and microchipping well in advance.

- Medical Records: Bring copies of your health history, prescriptions, and vaccination records.

- Driving: You may need an International Driving Permit to drive immediately upon arrival. Some countries will exchange your U.S. license for a local one without testing, others will not.

- Shipping Your Belongings: Factor in the cost and time of international movers. For some, selling most possessions and starting fresh is cheaper and less stressful.

- Voting Abroad: You can vote absentee in U.S. elections by registering with your last state of residence.

7. Final Checklist Before You Leave ✅

- Forward your mail through USPS or use a scanning service like Earth Class Mail.

- Notify all financial institutions of your move.

- Cancel utilities and subscriptions.

- Keep backup funds in both U.S. and foreign accounts in case of emergencies.

- Research healthcare coverage options thoroughly before departure.

Closing Thought

Selling your home and moving abroad can be the ultimate fresh start 🌴 but it is not something to do on a whim unless you like being blindsided by bureaucracy. Plan it carefully, get expert legal and tax advice, and, if you are from New Jersey, enjoy the satisfaction of no longer needing to pay those legendary property taxes.

Thinking about selling your NJ home to fund your move abroad? Contact NJ House Partners for a confidential consultation. We will help you sell quickly and profitably so you can start your next chapter with confidence.