Let’s be honest.

📉 You’re behind on your mortgage.

📬 The letters started as reminders. Now they sound like threats.

📵 You’re dodging calls.

😰 You’re overwhelmed, stressed, and unsure of your next move.

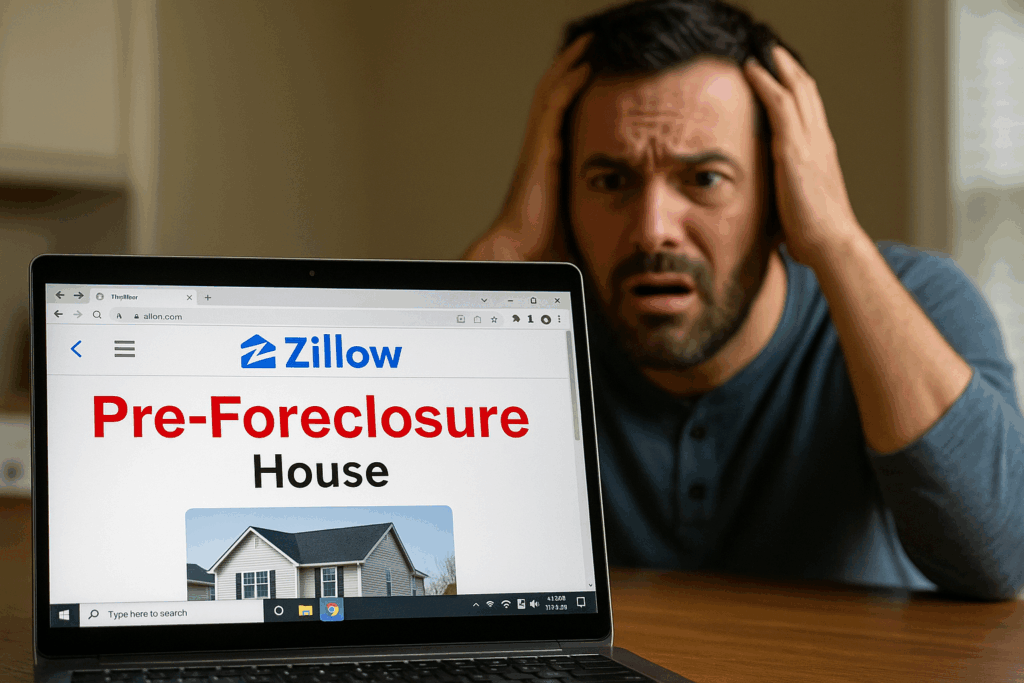

And now, your house is listed as “preforeclosure” on Zillow. That means your name, address, and financial situation are out there for the world to see. In New Jersey, where real estate is public record, this is how it all starts.

If you’re a homeowner in Bergen County or anywhere in the state, this is your wake-up call. You still have time to take action. But not much.

What Is Preforeclosure in New Jersey?

In New Jersey, preforeclosure begins when you fall behind on your mortgage. You still own your home, but the foreclosure process has started.

Here’s how it works:

- Day 1: You miss a mortgage payment. The bank sends a reminder letter.

- 30–90 Days Late: The lender sends you a Notice of Intent to Foreclose, as required by New Jersey law.

- After 90 Days: A Lis Pendens is filed with the County Clerk. In Bergen County, that filing is public record and automatically picked up by sites like Zillow and Redfin.

- Then: Your property is marked as “preforeclosure” online. Anyone searching your address can see it.

- Final Step: If no resolution is reached, the lender files a foreclosure complaint. The process can take 6–9 months before a Sheriff Sale is scheduled.

New Jersey is a judicial foreclosure state, meaning everything goes through the courts. That gives you a window to act, but the timeline is not as generous as people think.

Your Real Options in Preforeclosure

You have five main paths. Only two of them give you real control.

1. 💸 Reinstate the loan

You pay back everything you owe; the missed payments, late fees, attorney costs, and any interest that’s accumulated.

If you have the cash, do it. Most people don’t.

2. 📑 Loan modification

The lender may offer to modify your loan. That sounds great, until you realize what it involves:

- Tax returns

- Pay stubs

- Bank statements

- A hardship letter

- A monthly budget

- A full financial review

Even if you’re approved, they usually add the missed payments to the back of the loan as a balloon payment. This defers the pain. It doesn’t remove it.

And the kicker? It can take 60 to 90 days to get an answer and many are denied.

3. 🕐 Forbearance or repayment plan

Lenders may let you pause payments temporarily or offer a structured repayment plan.

But don’t count on it. The market has changed since COVID.

According to the CFPB, 38% of homeowners who exited forbearance between 2021 and 2023 were not current on their mortgages one year later. Many ended up back in foreclosure.

In today’s market, especially in high-demand areas like Bergen County, lenders are less likely to delay. They can sell the property at a profit, so they won’t wait forever.

4. 📉 Short sale

If your home is worth less than what you owe, you can ask your lender to approve a short sale.

But this is a lengthy, paperwork-heavy process. It requires bank approval and can take 3 to 6 months. If your property already has a sheriff sale scheduled, it might be too late for this option.

5. ✅ Sell the property before foreclosure

This is the fastest, cleanest exit. You avoid a court judgment, protect your credit, and walk away with any equity you still have.

This option works best when you move quickly and know what your home is worth.

Why Selling Before Foreclosure Is a Smart Move in NJ

Here’s what happens when you wait too long in New Jersey:

- 🚫 A foreclosure judgment hits your credit for 7 years

- 📃 A public legal record follows you

- 🧾 You lose any control over the sale date or process

- 🏚️ A sheriff sale often brings in less than market value

- 🕵️ Your name ends up on public lists used by debt collectors and solicitors

Now compare that to selling before the judgment:

- ✅ You protect your credit

- 💵 You keep whatever equity is left

- 🔒 You control the sale timeline

- 😌 You avoid court, lawyers, and public auctions

In Bergen County, sheriff sales are held weekly and the backlog is shrinking. That means your sale date may arrive faster than you expect.

Can You Still Sell? Absolutely.

🏠 You still own the home until the sheriff’s gavel falls.

📝 You still have the right to sell, even with a Lis Pendens filed.

⚠️ But once a final judgment is entered, your options shrink fast.

If your home has equity, or even if it just needs work, you can sell it before the bank does. And you should — before it’s too late.

You Have Two Paths in New Jersey

1. 🏡 List your home with a licensed Realtor

We can help with that. NJ House Partners is a licensed team with experience listing distressed properties fast.

We know how to:

- Work with your lender for payoff figures

- Navigate around title issues and open liens

- Market to buyers who can close fast including cash investors

- Keep the timeline tight and efficient

Many agents avoid foreclosure cases. We lean into them.

2. 💰 Sell directly to a local investor

If your house needs repairs, has a problem tenant, or you just want a clean, fast exit, this is often the better route.

At NJ House Partners, we buy homes all over Bergen County and North Jersey. We can:

- Make a no-obligation cash offer in 24 hours

- Pay off your lender directly

- Close in as little as 10 to 14 days

- Handle any cleanup, legal issues, or tenant problems

- Give you flexibility to stay in the home briefly after closing, if needed

What NJ House Partners Does Differently

We specialize in distressed sales, including:

- 🧱 Properties in disrepair

- 🧾 Tax liens and title issues

- 🪪 Probate and inherited homes

- 🧹 Hoarder conditions

- 🔐 Tenant-occupied rentals

- ⚖️ Divorce or legal situations

✅ No agent fees or commissions (unless you go the listing on the MLS route)

✅ No repairs or cleaning needed

✅ No banks or appraisals

✅ We handle the paperwork

✅ We work around your timeline

Whether you’re in Bergenfield, Dumont, Hackensack, Teaneck, Englewood, or Garfield, we’ve likely helped a neighbor of yours already.

Frequently Asked Questions

🔎 What if I already received a Lis Pendens?

You can still sell. That’s just a notice that a lawsuit was filed. You still own the home and have the right to sell.

⏱ How fast can you close?

In as little as 10-14 business days. Most sales close in under 30.

🔨 What if the house is falling apart?

We buy homes as-is. You do not need to make any repairs.

📉 What happens to my mortgage balance?

We get a payoff quote from your lender and pay it off directly at closing. Any remaining equity goes to you.

📦 Can I stay after closing for a few weeks?

In many cases, yes. We can write that into the agreement if you need time to relocate.

Final Takeaway for NJ Homeowners

If you’re in preforeclosure in Bergen County or anywhere in North Jersey, you are not out of options but you are on the clock.

Zillow already exposed your situation. The legal filings are piling up. The sheriff’s calendar is filling fast. But you can still act.

📞 Call or text 201-214-1349

📩 Or visit NJHousePartners.com for a confidential cash offer or listing consultation

You don’t need to go through court.

You don’t need to let the bank decide your future.

You just need to act now, while you still can.