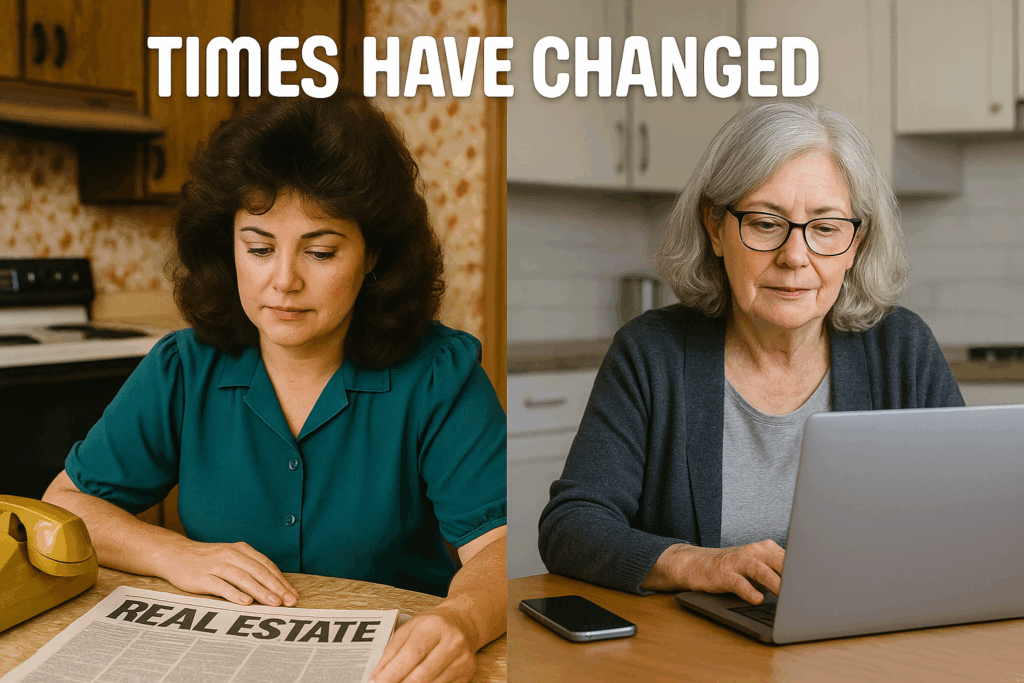

Many New Jersey baby boomers bought homes in the ’70s, ’80s, or ’90s, when real estate was a far simpler process. Today’s market is a completely different beast. Here’s a detailed breakdown of the top 10 changes, what they mean, and stats to back them up:

1. 📋 Digital Listings, Virtual Tours & Instant Exposure

Then: Listings appeared in newspapers or mailed flyers.

Now: 92% of buyers begin with online searches. Photos, virtual tours, drone shots, and floor plans are standard. Homes without strong digital presence get ignored.

Why it matters: Homes need marketing-grade visuals and staging before hitting the market to stay competitive.

2. 🏦 Stricter Financing

Then: Stated-income loans and flexible underwriting were common.

Now: Lenders require credit scores, debt-to-income ratios, and full document verification post-2008. These requirements were significantly reinforced after the Patriot Act was passed in 2001. As part of anti-money laundering (AML) and anti-terrorism efforts, the Act requires lenders, title companies, and escrow officers to verify the identities of all parties involved in a real estate transaction.

What this means: Buyers must provide government-issued identification, Social Security numbers, and sometimes additional documentation if large amounts of cash are involved or if foreign accounts are used. These federal oversight regulations are particularly strict when it comes to identifying suspicious activity or non-transparent financial sources.

Statistic: Mortgages denied for incomplete documentation rose 20% from 2019–2023. Boomers need to verify buyers’ pre-approvals are solid and from vetted, reputable lenders.

Statistic: Mortgages denied for incomplete documentation rose 20% from 2019–2023. Boomers need to verify buyers’ pre-approvals are solid.

3. 💰 More Fees Than Ever

Selling today comes with far more fees than baby boomers may remember:

| Fee | Estimated Cost | Notes |

|---|---|---|

| Agent commissions | ~5–6% total (split between agents) | Still negotiable, but more openly discussed post-NAR settlement |

| Transfer taxes | ~0.8% base in NJ | Plus “mansion tax” for homes over $1M or $2M |

| Attorney/title/escrow fees | $1,200–$2,200+ | Closing coordination, title search, legal review |

| Exit tax | 2% of sale price or 8.97% of gain | Required for sellers leaving New Jersey |

| Buyer concessions | 1–3% of sale price | Closing cost credits, rate buydowns |

| Staging & prep | $800–$14,000 | Cleaning, painting, cosmetic repairs, home staging |

| Moving expenses | $7,000–$9,000+ | Long-distance moves or transitions to assisted living |

Note: While agent commissions have always been negotiable, today’s market expects greater transparency. Buyers now sign agreements clarifying who pays what.

4. 📜 The Surprisingly New “Exit Tax”

This tax often catches longtime homeowners off guard. If you’re selling your New Jersey home and moving out of state, the state requires that you pay either 2% of the total sale price or 8.97% of the capital gain as a withholding at closing.

Why it matters: This isn’t a separate tax, but a prepayment of your potential NJ income tax liability on the gain from the home sale. If you fail to account for it, it can reduce your available proceeds at closing and delay moving plans. Many sellers need help from a CPA or real estate attorney to calculate what they might owe.

But wait, some destination states have their own rules too. For example, Pennsylvania charges a 2% realty transfer tax on most home purchases, commonly split between buyer and seller. If you’re buying there, you may be responsible for half (1%) of the purchase price just to get in the door, effectively an “entry tax” that adds thousands to your closing costs.

Boomer tip: If you’re planning a move to Florida, the Carolinas, or Pennsylvania, be sure to account for both NJ’s exit tax and potential entry taxes in your next state.

5. 🛠️ Home Inspections Are Deal-Breakers

In past decades, buyers were more likely to accept homes “as-is,” handling repairs themselves after closing. Today’s buyers expect move-in-ready conditions and use inspections to negotiate price reductions, demand repairs, or cancel contracts altogether. However, in hot markets with low inventory, some buyers may choose to waive the home inspection contingency altogether just to stay competitive, especially if there are multiple offers on a property.

Common inspection triggers:

- Roof age or condition

- Electrical panel issues

- Underground oil tanks (still common in NJ)

- Termite or moisture damage

- Mold and radon presence

Tip: Conduct a pre-listing inspection. It may cost a few hundred dollars, but it gives you control over repairs, improves buyer confidence, and reduces surprises once under contract.

6. ⏳ Longer Appraisal & Underwriting Times

In the ’80s or ’90s, you might close in 30 days or less. Today, even with automation, transactions can take 45–60 days due to tighter lending regulations and appraisal delays.

Why the slowdown?

- Appraisal scheduling backlogs (especially in rural or luxury markets)

- Underwriters now verify employment, income, and assets multiple times before closing

- Conditional approvals often result in requests for further documentation

Impact on sellers:

- Delayed closings can affect your own move-out timeline or financing for a new home

- Appraisals that come in low can kill deals or force price renegotiations

Boomer tip: Choose buyers with reputable lenders, verified pre-approvals, and flexible timelines. Ask your agent to communicate frequently with both the lender and the buyer’s agent.

7. 🧓 Today’s Buyers Look Very Different

Then: First-time buyers were typically married couples in their 20s or early 30s with young children.

Now: The median age of a first-time homebuyer is 35, and 58% of recent buyers have no children under 18, according to NAR’s 2024 Profile of Home Buyers and Sellers.

Why it matters: The classic “starter home” has largely vanished due to affordability issues. Many buyers now skip directly to larger, more long-term properties—and have different priorities like home offices, walkability, or aging-in-place features.

Boomer tip: Homes that feel dated or oversized for modern lifestyles may need thoughtful updating or repositioning in marketing.

8. 🏡 Selling Strategy Comes With Playbook

Then: List high, wait around.

Now: You price to attract multiple bids, run targeted ad campaigns, open houses, and social media exposure.

Data point: 85% of homes sell within 2% of list price if marketed properly and staged.

9. 🤔 Buyers Are Savvier & More Skeptical

Buyers use data tracking, websites, and public records to question price discrepancies, old roofs, environmental issues, or past renovations. House history transparency is expected.

Insider tip: Provide disclosures upfront, radon results, termite reports, or roof warranties—before potential buyers raise red flags.

10. 🧰 Hybrid Agents Offer Flexible Solutions

Then: You hired a listing agent who helped you find a buyer, and that was that.

Now: A very small number of real estate professionals work as both licensed agents and seasoned investors, commonly referred to as “hybrid agents.”

Why it matters: Hybrid agents can offer solutions that traditional agents can’t, such as:

- Making all-cash offers with flexible move-out timelines

- Purchasing your home as-is, eliminating the need for repairs, showings, or staging

- Listing your home traditionally if you want to test the market for top dollar

- Providing a guaranteed fallback option if the traditional sale doesn’t pan out

As one of the few hybrid agents in New Jersey, I provide both investor insight and full MLS exposure. This dual approach helps clients avoid double moves, reduce stress, and choose the path that works best for their personal and financial goals.

Boomer tip: Ask if your agent is also an experienced investor who can offer direct-buy or creative exit options. It could make your transition far easier in today’s evolving market.** Ask potential agents if they offer both listing and direct-buy options. It might save you time, money, and hassle—especially in today’s fast-moving market.

🧓 Final Thoughts for New Jersey Baby Boomers

If you’re a boomer considering selling, these aren’t your parents’ home sales. Today’s market demands strategic digital marketing, savvy negotiations, financing awareness, and a reserve budget for new seller costs.

Essential steps:

- Partner with a modern agent who communicates digitally and understands today’s MLS and commission landscape

- Budget for closing costs (8–12% of sale price), inspections, staging, exit tax, moving, and concessions

- Prepare disclosures and a pre-sale inspection to avoid surprises