Meta Title: NJ Homeowners Face Surging Insurance Costs in 2025

The Hidden Cost Threatening Homeownership in New Jersey 😱💸

Most people think about mortgage rates, property taxes, or HOA fees when calculating housing affordability—but there’s a silent killer creeping in: homeowners insurance.

And it’s hitting New Jersey in a big way.

According to the Insurance Information Institute, national premiums have increased by 23% between 2021 and 2023, with some states seeing jumps as high as 40%. And while NJ has traditionally avoided the worst storms and wildfires, premiums here are climbing too—especially in flood-prone areas and older homes.

If you’re planning to buy, sell, or stay put, here’s why you can’t ignore rising insurance premiums in 2025.

What’s Causing Insurance Premiums to Spike? 📊🌪️

- Climate change: Stronger storms and flash flooding events are driving up claims, even in suburban areas.

- Rebuilding costs: Materials and labor have skyrocketed. Insurers are recalculating replacement value.

- Insurance pullouts: Major carriers are exiting high-risk markets, shrinking competition and raising prices.

- Claim history: Older homes with prior issues are being flagged for premium hikes or denied coverage altogether.

“New Jersey saw a 20% increase in average premium costs in 2024, according to ValuePenguin. And that’s expected to continue in 2025.” 📈

The Impact on Homeowners and Buyers 🧾🚪

- Monthly payments are going up: Even with a low mortgage rate, a rising premium can tank your monthly budget.

- Sellers are losing buyers: Higher premiums mean fewer buyers qualify for financing, especially for older or coastal homes.

- Delayed closings: More underwriters are scrutinizing policies, and some lenders require last-minute premium adjustments.

What It Means for the NJ Real Estate Market 🏘️💼

- Homes in flood zones or older homes may sit longer on the market or require price reductions.

- Buyers with tight DTI ratios may be pushed out of qualification.

- Savvy sellers and agents will need to disclose potential premium issues upfront to avoid lost deals.

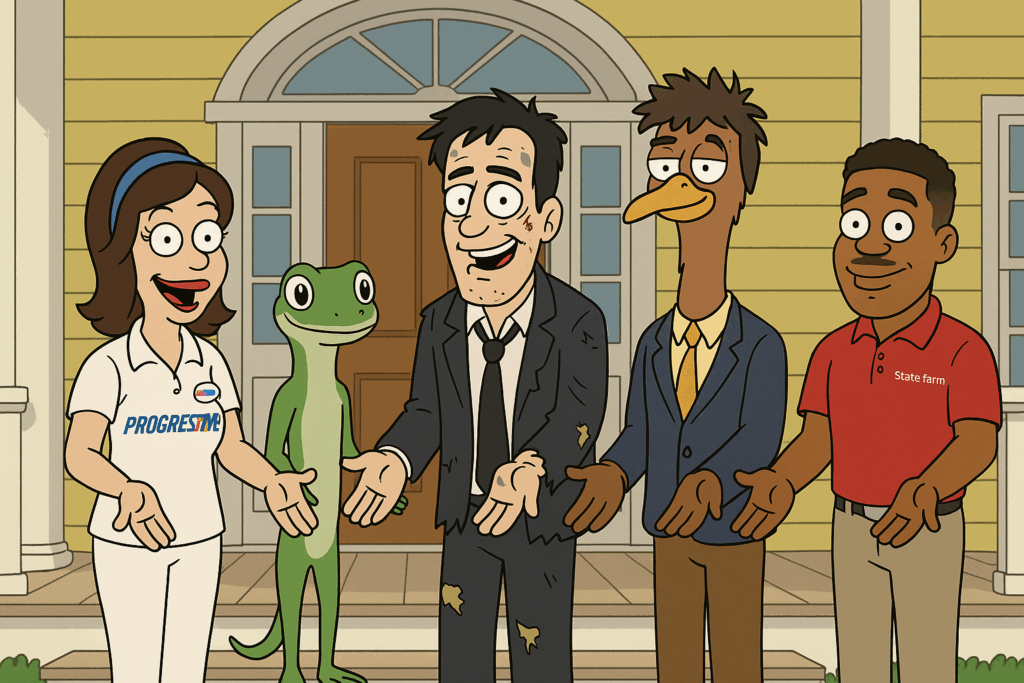

National Trouble Spots: What NJ Can Learn from California and Florida 🌍📉

New Jersey isn’t alone in its insurance woes—states like California and Florida are flashing warning signs:

- California: Major insurers like State Farm and Allstate have stopped issuing new homeowners policies due to wildfire risks and the rising cost of claims. That’s left many Californians scrambling for coverage from less-known carriers or turning to the state-backed FAIR Plan. Premiums in some wildfire-prone regions have tripled. 🔥🏡

- Florida: A top relocation destination for many New Jersey retirees, Florida’s insurance market is in crisis. Due to hurricane risk and excessive litigation, dozens of insurers have gone under or pulled out. New policies often require:

- Roofs under 10 years old 🏚️➡️🏠

- Flood insurance—even in “non-flood” zones due to updated FEMA maps 🌊

- High deductibles and exclusions 🚫

These requirements are driving up costs and complicating purchases—especially for out-of-state buyers used to more stable insurance markets.

If the trends in NJ continue, we may see similar carrier exits, stricter requirements, and rising default rates. 🚨

What Homeowners Can Do Now 🛠️💡

- Shop around: Don’t let your current carrier auto-renew without checking competitive rates.

- Bundle wisely: Car + home bundling can save hundreds. 💵

- Improve risk features: New roof, updated electrical, flood vents, and sump pumps can all reduce premiums. 🛡️

- Request a CLUE report: Know your home’s claim history before listing.

For Buyers:

- Ask for a preliminary insurance quote before making an offer, especially on older or coastal homes. 📝

- Build premium estimates into your total monthly budget. 💸

For Sellers:

- Be proactive: provide recent insurance bills and info about updates to the roof, plumbing, electrical, or mitigation systems. 🏘️

- Stage your home’s maintenance as much as its aesthetics. 🧹🪟

Final Thoughts 💭

Rising premiums aren’t just a nuisance—they’re becoming a market disruptor. In a state where affordability is already strained, New Jersey homeowners, buyers, and sellers can’t afford to ignore this. 🚫🏠

Stay informed, work with a knowledgeable agent, and don’t wait until closing day to uncover hidden costs.

Kevin Hill

Hybrid Real Estate Agent | NJ House Partners

☎️ 201-214-1349

🌐 www.njhousepartners.com