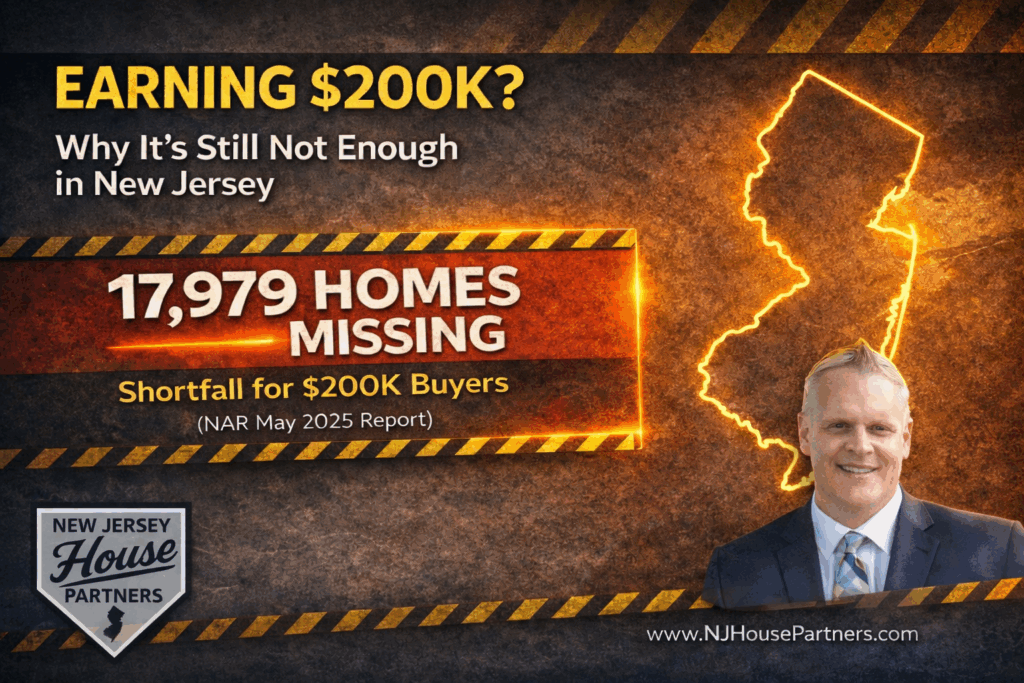

Even $200,000 income buyers face a 17,979 home deficit in New Jersey, according to the NAR May 2025 Affordability Report.

Turn on the news and you will hear that the housing market is improving. Inventory is up. Buyers supposedly have more choices. Some markets are even reporting slight price relief.

But if you are searching for a home in Bergen, Essex, or Passaic counties, none of this feels true.

A May 2025 report from the National Association of REALTORS confirms what North Jersey buyers already know. While many parts of the country are slowly moving toward balance, the New York–Newark–Jersey City metro is officially classified as a market that is falling further behind. Supply remains nowhere near sufficient for the number of buyers searching, and the gap between what households can afford and what is actually for sale continues to widen.

This is why national headlines do not reflect our reality. North Jersey is operating in a different housing economy, and understanding this difference is critical for anyone planning to buy in 2025.

The 21,000 Home Hole: The Math Behind the Crisis

One of the most important findings of the NAR report is the quantifiable size of our regional affordability deficit. These are not vague trends. They are exact numbers showing how far supply falls short for the most active income brackets in North Jersey.

According to the report, the NY–NJ–PA metro is missing:

- 20,782 listings affordable to households earning $100,000

- 21,973 listings affordable to households earning $125,000

- 21,159 listings affordable to households earning $150,000

Combined, this is a deficit of more than 60,000 homes for buyers who make up the backbone of North Jersey’s homebuying demand.

This is the “Missing Middle.”

These buyers are financially strong, employed in stable industries, and fully qualified. Yet they are competing for a tiny fraction of listings because the price points that match their incomes simply do not exist in the numbers needed.

National Buyers Have Lost Ground Since 2019. North Jersey Buyers Have Lost Much More.

The NAR report provides crucial context for how affordability has shifted nationwide.

A household earning $100,000:

- Could afford 64.7 percent of homes in 2019

- Can afford 37.1 percent of homes in 2025

- Would need access to 60.7 percent of homes for the market to be balanced

- Faces a national shortage of 364,000 homes priced under $340,000

Now compare that to North Jersey, where many entry level homes begin well above that $340,000 mark. When the national picture worsens, high cost regions experience the full impact even more intensely.

How Far Incomes Really Go in 2025

The NAR report outlines maximum affordable purchase prices using standard lending guidelines:

- A household earning $75K can afford up to $254,780

- A household earning $100K can afford up to $339,700

- A household earning $125K can afford up to $424,630

- A household earning $150K can afford up to $509,560

These numbers tell the story clearly. In Bergen, Essex, or Passaic counties, listings in these ranges are minimal. Even homes that need updating regularly sell in the $500K to $700K range. Buyers with solid incomes are being priced into older inventory, longer commutes, or aggressive renovation projects because the market is structurally short at the very price points they can afford.

Why New Jersey Is Falling Further Behind

The NAR report divides the nation’s 100 largest metros into three categories:

- Areas getting closer to balance

- Areas stuck in the middle

- Areas falling further behind

North Jersey is in the third group.

These are the metros where affordability gaps are widening, not shrinking, and where rising national inventory is not translating into meaningful opportunities for local buyers.

Two underlying issues drive this.

1. Inventory Growth Is Happening in Other Regions

The report notes a construction driven inventory recovery in parts of the South and West. States like Texas, Florida, Tennessee, and Colorado have added significant supply, some even surpassing pre pandemic levels.

North Jersey has not experienced anything similar. High land costs, limited buildable lots, slower development timelines, and higher construction expenses create structural barriers to adding affordable inventory.

2. The Filter Down Effect Is Broken

In a functioning market, higher income buyers move up into luxury homes, which frees up mid tier homes for the next group of buyers. However, the report shows that even households earning $200,000 in high cost metros like ours face limited options. When the top of the market is constrained, no inventory filters down. This locks buyers at every level into place and intensifies competition for the few appropriately priced homes that do hit the market.

Why Waiting for the Market to Cool Is a Risky Strategy

Some national experts recommend waiting for prices to drop. That advice does not apply in our region.

Here is why:

- The Affordability Distribution Score for our metro remains well below 1, which means we are far from a balanced market

- Middle income buyers are short more than 60,000 listings at their ideal price points

- Even a modestly priced home in North Jersey draws multiple offers if it is turnkey or well located

- Rising inventory nationally is concentrated in markets that do not affect North Jersey supply at all

Waiting does not create more homes. It only increases the odds that the right home sells to someone who acted decisively.

How to Compete and Win in a Market That Is Falling Behind

You can still succeed as a buyer in North Jersey, but passive strategies will not work. You need a localized, data driven approach.

1. Ignore National Averages

National housing data is interesting, but it is irrelevant to your experience. Our region is an outlier, and decision making must be rooted in hyper local analysis.

2. Be Strategically Aggressive

Well priced homes in the $500K to $700K range will continue to draw strong competition because this is where the affordability deficit is most severe.

Winning often comes down to:

- Clean offer terms

- Local lender strength

- Flexible closing timelines

- A compelling structure beyond just price

3. Expand Your Search to Micro Markets

Some towns and neighborhoods still have pockets of available inventory. A strategic search radius can make a meaningful difference in what becomes available.

Bottom Line

The 2025 housing market in New Jersey is not broken. It is simply unbalanced. The wave of inventory improving other parts of the country has not reached our region, and the affordability gap for middle income buyers remains one of the widest in the nation.

If you want to buy successfully in North Jersey, you need more than a Zillow alert. You need a partner who understands the math, watches the inventory before it becomes public, and can guide you through a market that continues to fall behind.

Contact NJ House Partners for a data driven strategy session tailored to your goals and the real conditions in the 2025 North Jersey market.