HELOCs Are Quietly Becoming the Next Mortgage Crisis

Most people assume that mortgage delinquencies start with first liens—the main mortgage on a home. But according to TransUnion’s latest data and commentary from asset managers on Wall Street, the real stress is coming from somewhere else: home equity lines of credit (HELOCs).

Jason Lewis, CEO of Aryming Capital and a specialist in second liens, put it bluntly:

“The next mortgage delinquency wave isn’t coming from first liens—it’s being triggered by HELOCs hitting repayment.”

Why This Matters: The Payment Shock

When a HELOC “draw period” ends, homeowners stop making small interest-only payments and suddenly must pay back principal + interest. That’s when the payment shock hits.

- TransUnion found that delinquent first-lien borrowers had HELOC payments averaging $124 higher per month than those still current.

- Over the next three years, more than 100,000 HELOCs worth $4 billion+ will roll into repayment.

- Lenders are already reporting cracks, with early trouble showing up in the Southeast and spreading outward.

For New Jersey homeowners, already carrying some of the nation’s highest property taxes, this extra hit could tip budgets into the red.

A New Jersey History Lesson: HELOCs and the Housing Bubble

To understand why this matters locally, it helps to rewind.

In the early 2000s housing boom, HELOCs were everywhere in New Jersey.

- Rising home values in Bergen, Essex, and Passaic counties allowed homeowners to tap their equity like an ATM.

- It wasn’t unusual to see families pull $50,000–$100,000 through a HELOC to renovate kitchens, pay tuition, or consolidate credit card debt.

- Lenders aggressively marketed these products because values were rising so fast that equity seemed like an endless safety net.

Then came the 2008 housing crash.

- HELOC balances suddenly exceeded home values, leaving many New Jersey homeowners “underwater.”

- Borrowers who couldn’t refinance or sell were stuck with second liens they couldn’t pay, and banks took heavy losses.

- Many North Jersey foreclosures in 2009–2013 weren’t just from unpaid first mortgages—they were triggered by second-lien defaults.

Fast forward to 2020–2021, during the pandemic boom:

- Rock-bottom interest rates and record home appreciation led to a second wave of HELOC popularity.

- Families in Bergen County, Union County, and Middlesex County once again borrowed against their equity, this time to fund remote work upgrades, invest in second homes, or simply offset higher living costs.

- Unlike 2006, many borrowers were more cautious, but balances still piled up.

Now, in 2025, we’re reaching the end of those draw periods. The math looks familiar: payments jump, income ratios climb, and cracks begin to show. For longtime NJ homeowners who lived through 2008, this has an uncomfortable sense of déjà vu.

The “Canary in the Coal Mine”

Wall Street looks at HELOCs as the leading indicator for broader mortgage trouble. Why? Because when second-lien payments become unmanageable, first-lien performance quickly follows.

For homeowners, this isn’t an abstract finance story. It’s about affordability today. If your HELOC draw is ending in 2025, your monthly costs may jump overnight—and if you’re already stretched thin, keeping up could become impossible.

What This Means for NJ Homeowners

Here’s the reality for local families:

- North Jersey property taxes are among the highest in the U.S.

- Utility bills are up 20–30% in 2025 compared to last year.

- Insurance premiums keep climbing.

Now add a sudden $200–$400 jump in monthly HELOC payments. Many homeowners will feel trapped, watching their budgets collapse under the weight of “house-rich, cash-poor” reality.

Real-World Example: Bergen County HELOC Stress

Take a Bergen County homeowner who took out a $75,000 HELOC in 2015. For the last 10 years, they paid interest-only at 4.5%—around $280 per month.

In 2025, the repayment period kicks in. Their payment now includes principal, and even if the rate stayed modest, their monthly bill may jump to $650–$700.

Combine that with:

- $1,200+ monthly property taxes

- A first mortgage of $2,500

- Higher energy and insurance costs

Suddenly, a once-manageable budget is stretched to the breaking point. If they lose a job, face a medical bill, or even just deal with inflation, staying current on both loans may no longer be possible.

A New Alternative: Fintech Equity-Sharing Products

As HELOC pressure rises, some New Jersey homeowners are turning to fintech equity-sharing agreements as an alternative. Companies like Hometap, Unlock Technologies, and Point Digital Finance offer homeowners cash today in exchange for a share of their home’s future value.

Here’s how it works: instead of taking on new monthly debt, you receive a lump sum with no monthly payments and no credit check. This makes them especially appealing to homeowners with poor credit or those already carrying high debt.

- Hometap has originated over 10,000 contracts totaling $1 billion+ as of 2024.

- Unlock Technologies has funded more than 5,000 agreements in recent years.

- Point Digital Finance, one of the earliest players, has completed thousands of deals nationwide and markets itself heavily in high-equity states like New Jersey.

While these products sound attractive, there are risks. Homeowners must eventually settle up when they sell or refinance, often paying a much larger amount than they received upfront. Regulators have raised concerns about unclear disclosures, and some contracts have been criticized as resembling reverse mortgages without the same protections.

At this stage, there is no publicly available data on failure rates or defaults for these fintech contracts. Unlock has openly acknowledged it does not release data on contract performance, and state attorneys general (including Massachusetts) have begun challenging some practices.

The bottom line: fintech products can provide relief if you’re in a credit crunch, but they are not a magic fix. Homeowners should weigh long-term costs carefully before trading away a piece of their future equity.

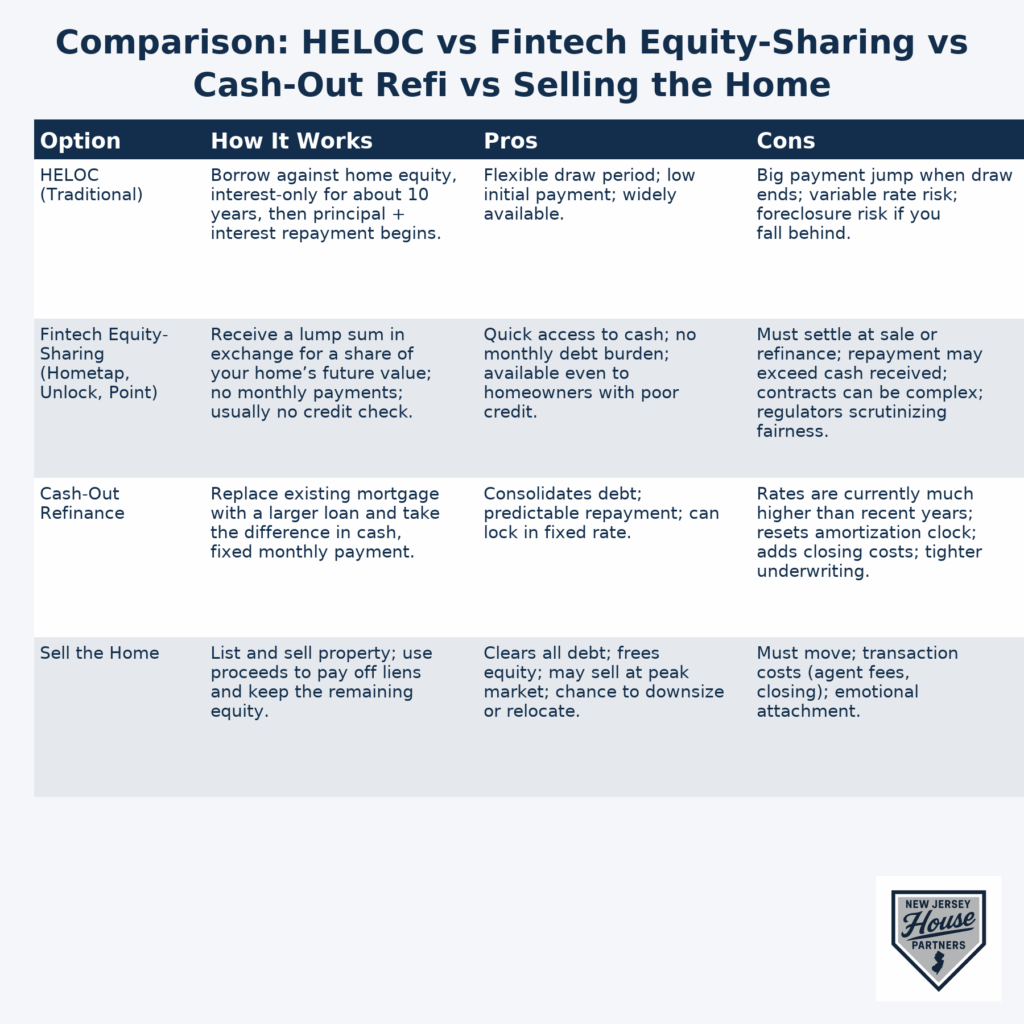

Comparison Chart: Your Options at a Glance

Options Before It’s Too Late

If you’re facing an expiring HELOC in New Jersey, here are your choices:

- Debt consolidation – Some lenders may restructure your HELOC and roll it into one loan.

- Refinancing – If your credit is still strong, refinancing before you miss payments may lower costs.

- Selling the home – In Bergen County and North Jersey, demand is still high. Selling before you fall behind lets you protect your equity and avoid foreclosure.

- Exploring fintech options – HEI products like Hometap, Unlock, and Point may provide cash with no monthly payments, but homeowners must tread carefully.

At New Jersey House Partners, we work with homeowners in exactly this situation. Whether you want to list for top dollar, explore quick investor options, or simply understand the pros and cons, we’ll help you find the best way forward.

Final Word

The experts are clear: HELOC expirations are the roadmap for the next distressed mortgage wave. For New Jersey homeowners, that means payment shocks, stress, and difficult decisions.

The worst move is waiting until you’re behind. You still have control today.

📞 Call NJ House Partners at 201-214-1349 or visit NJHousePartners.com to explore your options before the payment shock takes over.