If you’ve owned your condo in Hackensack, NJ for more than five years, you’re likely sitting on a significant amount of equity. But with so many luxury apartments rising across the city, interest rates fluctuating, and buyer behaviors shifting, many condo owners are asking: Is now the right time to sell? 🤔

Let’s take a deep dive into the market trends, the competition from new construction, and what it all means for sellers looking to maximize value in 2025. 📊

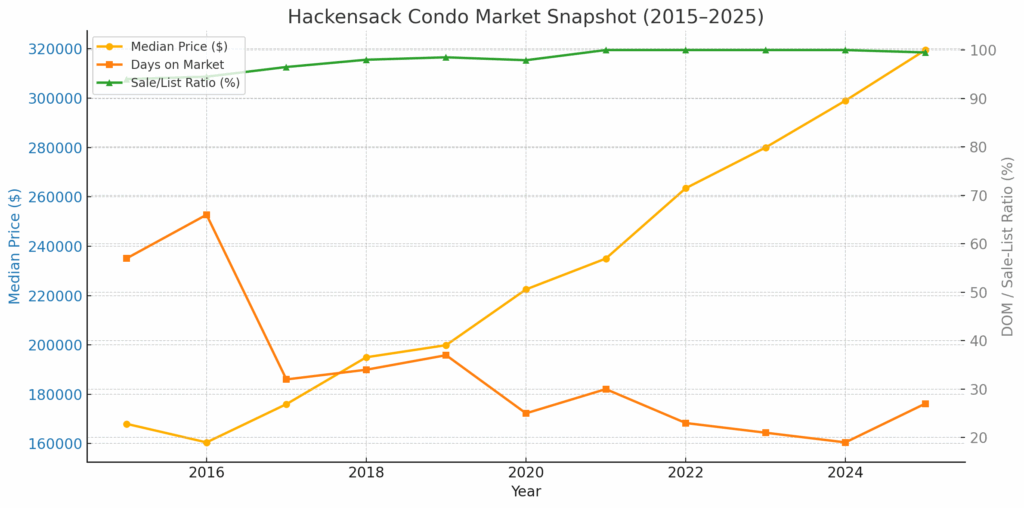

Hackensack Condo Prices Have Nearly Doubled 💰

According to NJMLS data from 2015 through mid-2025, Hackensack condo prices have seen steady, almost uninterrupted growth:

- 2015 Median Sale Price: $168,000

- 2020 Median: $222,500

- 2023 Median: $280,000

- 2025 YTD Median: $319,500

That’s a 90% increase over ten years. If you purchased your condo before 2020, chances are you have built substantial equity, possibly over six figures depending on your original purchase price. 💸

Homes Are Still Selling Fast, But Days on Market Just Tick Up ⏳

- 2020 Median DOM: 25 days

- 2023: 21 days

- 2024: 19 days

- 2025 (YTD): 27 days

We saw a historic low in 2024, but 2025 is showing the first signs of softening. Condos are still selling quickly, but buyers are no longer jumping quite as fast. This shift is subtle but important.

Sale-to-List Price Ratios Remain Strong… for Now 📈

In 2015, sellers were getting about 94 to 95% of their asking price. From 2021 through early 2024, the average sale-to-list ratio jumped to 100% or more. Buyers were routinely offering full price or better.

In 2025, this ratio is still strong, averaging 99.5% to 100.3%, but January dipped to 98.1%. This suggests that overpricing is being punished while realistically priced homes still perform well.

Listings Are Rebounding, Buyers Are Not 📉

- 2021: 338 listings / 292 sales

- 2023: 243 listings / 211 sales

- 2025 (YTD): 145 listings / 104 sales

New listings are up from the 2023 low, but the number of sales has not kept pace. That means more competition for sellers and potentially longer marketing times, especially for dated or poorly located units.

The Luxury Rental Boom Is Changing the Game 🏢

One of the most important shifts affecting the Hackensack condo market is happening in the rental sector. The city has seen a surge in Class A luxury apartment buildings that are changing the calculus for both buyers and sellers. These properties include Print House, The Brick, 210 Main, The Walcott, and Ivy and Green. They feature high-end finishes, fitness centers, rooftop decks, concierge service, and garage parking — amenities not typically found in older condo buildings.

Here’s a snapshot of current rental price ranges:

- Print House: Studios from $2,082–$3,702, 1-bedrooms from $2,529–$3,805, 2-bedrooms from $3,988–$6,174

- The Brick: 1-bedrooms approximately $2,550–$4,000

- 210 Main: Studios to 2-bedrooms around $1,951–$2,982

- The Walcott: Studios to 2-bedrooms roughly $2,510–$3,866

- Ivy and Green: Estimated at $2,300–$4,000+ for 1–2 bedrooms

These rents are competitive with, and often exceed, the monthly cost of owning a condo — especially when you factor in taxes, insurance, and HOA dues.

For first-time buyers or professionals relocating to Hackensack, renting in a brand-new building often feels more appealing than purchasing a condo that needs cosmetic updates and has a $500+ monthly HOA fee.

How the Florida Condo Collapse Changed the Rules in NJ ⚠️

The tragic 2021 collapse of the Champlain Towers South in Surfside, Florida, sent shockwaves through the condo industry nationwide — including right here in New Jersey. Since then, several changes have quietly reshaped the local condo landscape:

- Insurance Companies Are Stricter: Older NJ condo buildings are now under tighter scrutiny. Insurance carriers are demanding reserve studies, structural reports, and updated maintenance documentation before renewing or issuing policies.

- Lenders Want More Info: Fannie Mae and Freddie Mac have new rules requiring detailed inspection and funding records. Buildings with underfunded reserves or deferred maintenance may be flagged — making them harder to finance.

- Higher HOA Fees or Special Assessments: In response, many associations are raising monthly fees or imposing one-time assessments to catch up on needed repairs. This raises the cost of ownership and affects resale value.

- Buyer Hesitation in Older High-Rises: Buyers, especially younger ones, are more cautious. Units in older buildings without visible upgrades or clear reserve funding plans are becoming harder to sell.

These ripple effects are being felt in Hackensack, where many condos were built in the 1960s through 1980s. It’s more important than ever to understand your building’s financials, condition, and how it’s perceived in today’s risk-conscious lending and insurance climate.

The Condo Market Is Splitting 🔍

As a real estate agent who tracks both the MLS and Bergen County foreclosure docket weekly, I’m seeing a clear divide:

- Turnkey condos in updated buildings are still commanding full price or more

- Older units with high fees and no upgrades are sitting longer and selling at discounts

Sellers who adapt are still winning. Those who list based on pandemic-era expectations without updating or pricing realistically are missing the mark.

Why Condos Often Fall First in a Declining Market 📉

If the broader housing market softens, Hackensack condos are likely to feel the pressure before single-family homes. Historically, condos are the first to lose value when conditions shift.

Here’s why:

- Buyer Demographics: Condo buyers tend to be first-timers or investors, both more sensitive to rate hikes and economic uncertainty.

- Limited Land Value: Unlike single-family homes, condos don’t include land ownership, making them more vulnerable to devaluation.

- HOA Fees: High monthly fees can turn buyers away quickly when budgets get tight.

- Investor Exit: When the market cools, investors usually list first. This floods the market and leads to price drops.

In Hackensack, where many condos were built decades ago, those without updates or amenities are especially vulnerable if demand cools further.

What Should You Do If You Own a Condo in Hackensack? 🏡

If you purchased in or before 2019, you have options. The question is: what’s your goal?

✅ Sell Now If:

- You want to capitalize on your equity before the market balances out

- Your condo is outdated and you don’t want to renovate

- You’re planning to move, downsize, or invest elsewhere

⚠️ Hold If:

- Your building offers rare amenities and strong rental demand

- You have long-term tenants and cash flow is strong

- You bought at the peak and are still building equity

My Local Hackensack Experience 🏙️

As someone who has lived in both Stratford House and Bristol House, and sold units in Berkeley Arms, The Ambiance, and Union Condominiums, I’ve had boots-on-the-ground experience in Hackensack for years. I understand the nuances of each building, from HOA dynamics to what buyers care about most.

Final Word from a Local Expert 🗣️

The Hackensack condo market has been a fantastic place to build wealth over the past decade. But the signs of change are here: rising DOM, buyer hesitation, and intense rental competition are reshaping demand.

BONUS: Market Snapshot Graphic (2025 YTD) 📊

If you own a Hackensack condo and aren’t sure what your unit is worth or how to position it, let’s talk. I can give you a realistic price range, help you determine whether to sell, rent, or renovate, and connect you with cash buyers or traditional buyers depending on your goals.

Call Kevin Hill at 201-214-1349 or visit NJHousePartners.com for a no-pressure condo market consultation.