What Sounded Like Smart Advice Turned Into Financial Strain

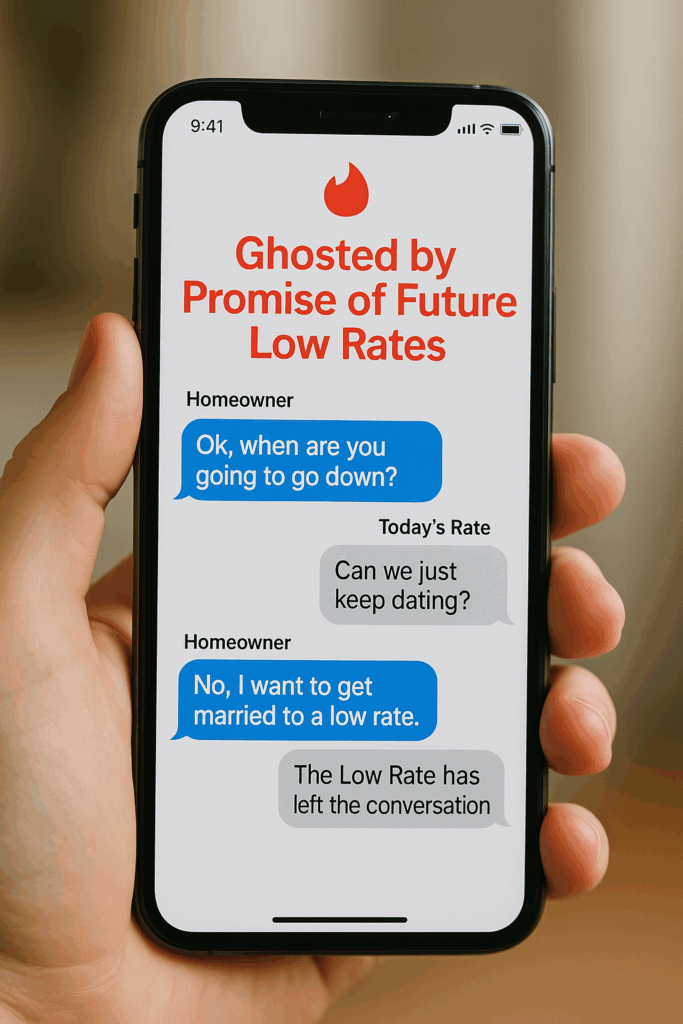

“Marry the house, date the rate” became a rallying cry during the post-COVID housing boom and personally made me cringe as it became a real estate agent catch phrase. The idea was simple: focus on buying the home you love now, because interest rates are temporary. You could always refinance later.

But that promise has not materialized. Instead, a wave of New Jersey homeowners, especially those who bought in 2021 through early 2023, are stuck with high payments, rising taxes, and few good options.

For some, that “date” with their mortgage rate has turned into a long, expensive relationship with no breakup in sight.

The Bergen County Buyer Who Believed the Hype

Let’s use a real scenario. A couple purchased a $675,000 home in Fair Lawn in August 2022:

- They put 20% down: $135,000

- Their loan amount was $540,000

- They secured a 6.875% 30-year fixed mortgage

Monthly principal and interest: around $3,540

Annual property taxes: around $12,500 ($1,042/month)

Homeowner’s insurance: around $160/month

Total monthly payment: approximately $4,742

This family had expected to refinance within 12 to 18 months. Fast forward to mid-2025 and they are still paying over $4,700 each month. The best refinance offer they have seen is 6.25%, which does little to improve the payment. Worse, their property taxes were reassessed in 2024 and increased by $1,100.

NJ Homeowners Are Feeling the Pressure

This is not an isolated case. Across New Jersey, buyers who stretched financially to purchase homes in a competitive market are now facing limited options.

- Mortgage rates hit 20-year highs in late 2023, peaking around 7.8% for a 30-year fixed

- New Jersey property taxes rose an average of 3.3% statewide in 2024, according to the NJ Division of Taxation

- Home insurance premiums climbed nearly 10% nationally in 2024, with even higher increases in urban areas due to rebuilding costs and climate risk

- Refinance volume in New Jersey dropped more than 60% from 2022 to 2024, according to ICE Mortgage Technology

Municipal reassessments have also hit homeowners hard. Towns such as Paramus, Teaneck, and Englewood have seen market-based revaluations that raised tax bills for recent buyers who purchased at peak values.

Why the “Date the Rate” Mantra Was Fundamentally Flawed

1. Mortgage Rates Do Not Follow a Script

The phrase assumed that mortgage rates would fall quickly and significantly. That did not happen.

The Federal Reserve’s efforts to combat inflation drove rates sharply higher in 2022 and 2023. While the Fed eventually paused hikes and signaled potential cuts, inflation has remained persistent. Mortgage rates in mid-2025 still hover between 6.25% and 6.75%.

2. Refinancing is Neither Simple Nor Guaranteed

Refinancing involves upfront costs that typically range from 2% to 4% of the loan amount. On a $500,000 loan, that is $10,000 to $20,000. Unless the new rate reduces your payment significantly, the cost may not justify the move.

Additionally, borrowers must meet lender requirements, which include:

- Strong credit scores

- Low debt-to-income ratios

- Adequate home equity

- Stable income and employment

Homeowners who put little down or relied on seller concessions in 2022 may not meet these standards in 2025.

3. Buyers Were Already Pushing Their Budgets

In 2022, more than 45% of New Jersey homebuyers paid over asking price, according to Redfin. In competitive areas such as Ridgewood, Glen Rock, and Montclair, the figure was even higher. Many waived inspections, borrowed down payments, or relied on gift funds to compete.

As a result, they entered homeownership with thin margins and little flexibility when interest rates failed to drop.

Local Data: The Financial Shift in Bergen County

Affordability has taken a hit across northern New Jersey. Here is a snapshot comparing recent years:

| Year | Median Home Price | 30-Year Rate (Avg) | Monthly P&I on $600k Loan | Avg Property Tax |

|---|---|---|---|---|

| 2020 | $550,000 | 3.00% | $2,530 | $11,500 |

| 2022 | $675,000 | 6.50% | $3,800 | $12,300 |

| 2025 | $700,000 | 6.25% | $3,700 | $13,000+ |

Despite minor slowdowns, home prices in Bergen County have not dropped significantly. Inventory remains low, especially for move-in-ready single-family homes. That scarcity supports home values but also traps current owners who hoped to upgrade or refinance.

If You Feel Stuck, You’re Not Alone

If you bought based on the belief that interest rates would quickly drop and are now financially strained, you are far from alone. Here are steps to consider:

1. Reevaluate Your Financial Picture

Run a full monthly budget. Account for principal, interest, taxes, insurance, utilities, repairs, and inflation. Ask yourself whether the home still makes long-term sense.

If you are constantly dipping into savings, relying on credit cards, or avoiding maintenance, the math may no longer work.

2. Consider Appealing Your Property Tax Assessment

Most homeowners never challenge their tax assessments, even when there is a strong case. If your town recently reassessed your home and overestimated its market value, you could lower your annual taxes and reduce your monthly payment.

3. Speak With a Local Professional

National advice and TikTok slogans do not reflect what is happening on the ground in New Jersey. Work with someone who understands your town, your market, and your local tax situation.

At NJ House Partners, we specialize in helping homeowners weigh their options—whether that means listing traditionally, exploring investor offers, or finding creative solutions.

4. Evaluate Exit Strategies

You may have more options than you think. Depending on your equity and location, selling the home could still yield $50,000 to $100,000 in proceeds even after transaction costs.

Some owners may also consider:

- Renting the property

- Selling to an investor for speed and convenience

- Downsizing within the same market

- Selling with a leaseback option to buy time

Every option has pros and cons. The key is having the numbers laid out clearly.

Lenders and Agents Should Know Better

A slogan like “marry the house, date the rate” benefits the seller and the lender more than it helps the buyer. It turns a complex financial decision into a soundbite.

In reality:

- Interest rates are not temporary if you cannot qualify for a refinance

- Equity gains do not matter if you cannot afford to stay in the house

- Refinancing may not be feasible if your financial profile changes

Agents and lenders who pushed this phrase as a universal truth did a disservice to many buyers. Homeownership can still be a smart long-term investment, but only when approached with realism and clear financial planning.

Final Thought

There is no shame in admitting that a purchase made under pressure and flawed advice is no longer working. What matters is what you do next.

Whether you are considering refinancing, renting, or selling, the most important thing is to base your decision on facts, numbers, and local insight, not social media slogans.

If you need help running the numbers or talking through your options, I’m here to help—no pressure, no judgment.

Let’s Talk

📲 Thinking about selling, refinancing, or just need to understand your options?

Contact Kevin Hill at New Jersey House Partners for an honest conversation about what makes the most sense for you and your home.