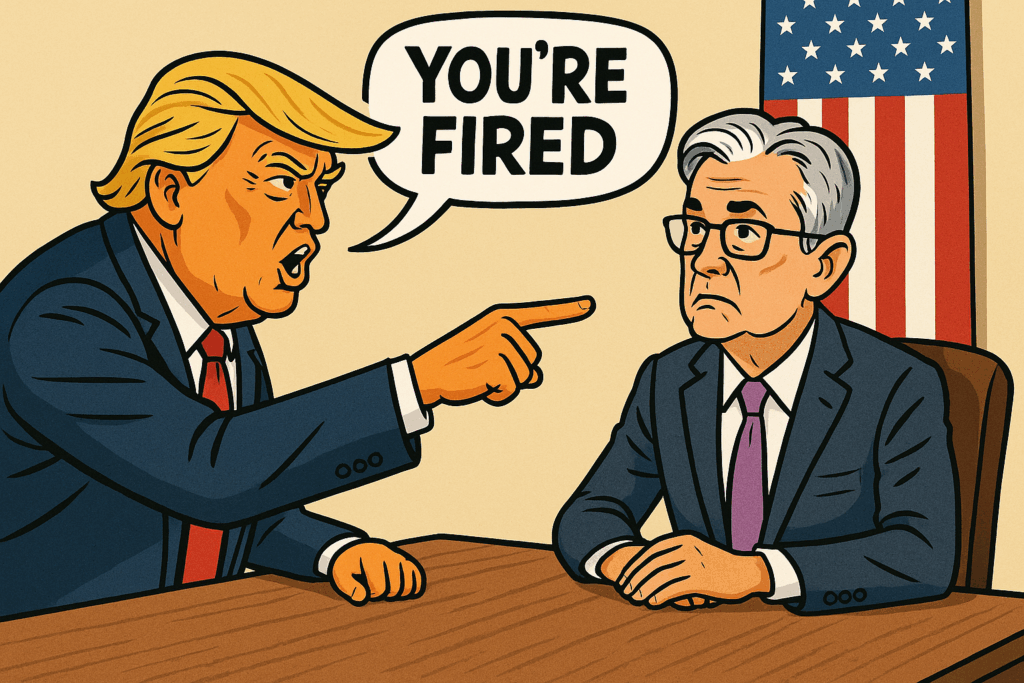

Trump’s next move? ‘YOU’RE FIRED’ — the rumored firing of Jerome Powell heats up!

The Federal Reserve plays a crucial role in the U.S. economy, particularly in shaping the housing market and mortgage rates. Jerome Powell, the current Chairman of the Federal Reserve, has been at the helm during one of the most turbulent economic periods in recent history, with rising inflation and significant changes to interest rates. Recently, reports surfaced that President Trump is contemplating firing Powell. But how would this drastic move affect the housing market and mortgage rates? Let’s take a closer look.

The Role of the Federal Reserve in Mortgage Rates and Housing 🏦

The Federal Reserve’s primary responsibility is managing the U.S. economy by adjusting interest rates to either stimulate growth or cool down inflation. Interest rates set by the Fed influence everything from savings accounts to home loans. Specifically, mortgage rates are directly tied to the federal funds rate, the interest rate at which banks lend money to one another. When the Fed raises or lowers this rate, mortgage rates tend to follow suit, making it more or less expensive for buyers to borrow money to purchase a home. 🏡

Under Jerome Powell’s leadership, the Federal Reserve has taken a cautious approach to raising interest rates, primarily to fight inflation. However, these higher rates have contributed to a slowdown in the housing market, with many prospective homebuyers facing higher monthly payments and reduced affordability.

Has Any Fed Chairman Been Fired Before? What Was the Effect? ⚖️

The possibility of firing a sitting Fed chairman is unprecedented. While U.S. presidents have clashed with their appointed Federal Reserve leaders in the past, no president has ever succeeded in firing a sitting Fed chair. The most notable case was in 1933, during the Great Depression, when President Franklin D. Roosevelt expressed dissatisfaction with then-Fed Chairman Eugene Meyer. However, Meyer was not fired and resigned voluntarily. The Federal Reserve was designed with some degree of independence to protect it from political pressures, ensuring that economic decisions are made based on data and long-term stability rather than short-term political gains.

If President Trump were to somehow bypass the legal restrictions on firing Powell, the move could potentially create immediate market volatility. The removal of a sitting Fed chair could destabilize the financial markets, causing uncertainty in both the stock and housing markets. Historically, such disruptions in leadership can lead to increased borrowing costs and a loss of confidence in the economic stability of the country, which would likely make mortgage rates more volatile.

Impact of Firing Powell on Mortgage Rates 📉

Firing Jerome Powell would undoubtedly create waves of uncertainty. While it is unlikely that a new Fed chair would make drastic changes to interest rate policies immediately, the transition itself could cause mortgage rates to rise due to the market’s reaction to uncertainty. Investors, including those in the housing market, dislike unpredictability. A sudden change in leadership could lead to increased risk premiums, which could raise borrowing costs for homebuyers.

Furthermore, if Trump or his successor were to appoint a more dovish chair (someone more inclined to lower interest rates), mortgage rates might decrease in the short term. However, such a move could also raise inflationary concerns, which would create an entirely new set of challenges for homebuyers and sellers. Lowering the interest rate would likely reduce the cost of borrowing, making mortgages more affordable and possibly stimulating more demand for homes. However, this could also lead to higher home prices and, in some cases, a potential housing bubble if demand exceeds available supply.

On the flip side, if a more hawkish Fed chair were appointed, one who focuses on raising interest rates to curb inflation, mortgage rates could rise significantly, further pushing homeownership out of reach for many potential buyers.

Does Lowering the Interest Rate Have a Direct Impact on Mortgage Rates? 📊

Yes, lowering the federal funds rate does have a direct impact on mortgage rates. When the Fed lowers interest rates, it reduces the cost for banks to borrow money. Banks, in turn, lower their lending rates, including mortgage rates, to stay competitive. As a result, homebuyers can secure loans at a lower cost, which may stimulate the housing market by making homeownership more affordable.

However, it is important to note that mortgage rates are influenced by a variety of factors, including inflation, bond market conditions, and global economic conditions. While the Fed’s actions are a major driver of short-term changes in mortgage rates, long-term trends are also shaped by these other factors.

Potential Impact on the New Jersey Housing Market 🏡📉

The New Jersey housing market is already facing significant challenges, particularly with low inventory. If Jerome Powell were fired and replaced with a more dovish Fed chair, we could see a reduction in mortgage rates, making it more affordable for buyers to purchase homes. This could encourage more homeowners to list their properties, especially those looking to upgrade or downsize. With lower mortgage rates, homeowners might feel more confident in selling their current home and purchasing a new one at a more favorable rate. This could potentially increase the number of homes listed for sale in New Jersey and provide some relief for buyers who are struggling with limited options.

However, there is also the possibility that this move could further exacerbate the low inventory problem in New Jersey. Many homeowners who are sitting on low mortgage rates from previous years may be reluctant to sell their homes, as doing so would mean taking on a higher mortgage rate for a new property. As a result, the housing inventory in New Jersey could remain tight, with fewer homes available for sale. This could lead to continued price increases, making it more challenging for first-time buyers or those looking to upgrade to find affordable options.

Could Lowering Rates Increase Buyer Demand and Help Free Up the Market in NJ? 💥📈

If mortgage rates were lowered, New Jersey could experience an even greater surge in buyer demand. With more affordable borrowing costs, first-time buyers and those looking to upgrade could flock to the market, hoping to secure a low-rate mortgage before any potential increases. This could lead to more competition among buyers, potentially driving up home prices in the short term.

However, the prospect of lower mortgage rates could also help free up the market by encouraging more homeowners to list their properties. As mortgage payments become more affordable, sellers might feel incentivized to upgrade to a larger home or downsize to a smaller one. This could increase inventory in a market that is desperately in need of more homes for sale. More homes on the market would give buyers more options and help balance the supply-demand dynamic in New Jersey’s competitive housing market.

Ultimately, lowering interest rates could stimulate both supply and demand in the New Jersey housing market, but the net effect would depend on the broader economic conditions, including inflation and job growth. If buyers continue to flood the market and more homeowners choose to sell, New Jersey could see a much-needed increase in housing inventory, easing some of the pressure on homebuyers.

The Possibility of Firing Jerome Powell 🔥

Recent reports indicate that President Trump is seriously considering firing Jerome Powell, even drafting a letter for his removal and discussing it with Republican lawmakers. While Trump has denied these intentions, saying it is “highly unlikely,” the situation remains fluid. According to sources, Trump has garnered support for the idea among lawmakers, and Representative Anna Paulina Luna has suggested that a firing could be imminent. While no president has ever successfully removed a sitting Fed chair, the potential for such a move would certainly create market volatility and could directly impact the housing market by affecting mortgage rates and investor confidence.

Why Interest Rates Should Be Lowered in the U.S. 🇺🇸📉

The U.S. currently has higher interest rates compared to many other first-world nations. Here are the key reasons why lowering rates could benefit the economy:

- Competitive Disadvantage vs. Other Countries 🌍

The U.S. has higher rates than many developed nations like Canada, the UK, and Japan. This puts American consumers and businesses at a disadvantage, as lower rates abroad make borrowing cheaper. - Relieving the Housing Market 🏠

High mortgage rates have reduced home affordability and slowed home sales. Lowering rates could make mortgages more affordable, stimulating demand and boosting the housing market. - Boosting Consumer Spending 💳

Lower interest rates would reduce borrowing costs for consumers, encouraging spending on big-ticket items like homes, cars, and appliances, which drives economic growth. - Encouraging Business Investment 📈

Lower borrowing costs would make it easier for businesses to invest in expansion, innovation, and hiring, boosting productivity and creating jobs. - Reducing Recession Risks 📉

High interest rates increase the risk of a recession by slowing down spending and investment. Lowering rates would support growth and reduce the chances of an economic downturn. - Encouraging Global Investment 🌎💵

Lower rates could attract more balanced investment into the U.S. while making U.S. goods more affordable abroad, benefiting exports.

What Happens Next? 🔮

Although the scenario of Trump firing Powell is unprecedented, it does highlight a critical issue: the tension between political pressures and economic stability. Regardless of who is at the helm of the Federal Reserve, changes in interest rate policies will continue to affect the housing market and mortgage rates. Homebuyers, sellers, and investors should stay informed about the developments in Washington, as they could signal important shifts in the broader economic landscape.

For now, it’s important for those in the market to remain flexible and prepared for potential fluctuations in mortgage rates and home prices. Consulting with a real estate agent or financial advisor can help navigate the current environment and make the most informed decisions.

Conclusion ✨

In summary, while the idea of firing Jerome Powell is unprecedented, the potential effects of such a move could have significant repercussions for the housing market and mortgage rates. A change in the leadership of the Federal Reserve could either stabilize or destabilize the economy, depending on the direction taken by the new chair. Whether rates rise or fall, the uncertainty itself is likely to have a direct impact on homebuyers, sellers, and overall market confidence.